表格1098-T资料

The 1098-T form is used by eligible educational institutions to report information about their students to the IRS as required by the Taxpayer Relief Act of 1997. 符合条件的教育机构须提交学生姓名, 添加ress, 及纳税人识别号码(TIN), 招生及学术状况. 从2003年开始, educational institutions must also report amounts to the IRS pertaining to qualified tuition and 相关费用, 以及奖学金和/或助学金, 应税与否. 1098-T表格也必须提供给每个适用的学生. 此表格仅供参考. It serves to alert students that they may be eligible for federal income tax education credits. 它不应被视为税务意见或建议. 虽然这是一个很好的起点, 1098 - t, 由美国国税局设计和管理, 不包含申请税收抵免所需的所有信息. There is no IRS requirement that you must claim the tuition and fees deduction or an education credit. Claiming education tax benefits is a voluntary decision for those who may qualify.

查阅1098-T税表:

表格1098-T学费税表将于1月31日提供给学生st. Students can log in to 自助服务 as soon as possible and consent to view the form online via the 税务信息 section of 自助服务. If no consent is received, a paper version of the form will be sent via postal mail.

- 登录到 自助服务

- Select 税务信息

- 请选择电子格式或纸质格式1098-T报表

如果以电子方式同意,声明将被列出供查阅或打印.

1098 - t常见问题

The 1098-T is used to report information to the IRS as required by the Taxpayer Relief Act of 1997. 符合条件的教育机构须提交学生姓名, 地址和纳税人识别号码, 招生及学术状况, 与合格学费有关的数额, 相关费用, 以及奖学金和/或助学金, 应税与否. 此表格仅供参考. 虽然这是一个很好的起点, 1098 - t, 由美国国税局设计和管理, 不包含申请税收抵免所需的所有信息.

美国国税局现在要求学院和大学, 从2018纳税年度开始, 在栏1申报(已收款项). Previously, 澳门网站游戏电子平台大专 was reporting in 框2 for amounts billed.

往年, your 1098-T included a figure in 框2 that represented the qualified tuition and 相关费用 (QTRE) we billed to your student account for the calendar (tax) year. 由于联邦法律对机构报告要求的改变, 从2018纳税年度开始, 我们将在方框1中报告本年度支付的QTRE金额.

取决于你的收入(或你的家庭收入), 如果你是受抚养人), 无论你是全日制还是半全日制学生, 以及你当年的合格教育费用, 你可能有资格获得联邦教育税收抵免. (你可以找到申请教育税收抵免的详细信息 IRS第970号出版物,第9页.)

The dollar amounts reported on your Form 1098-T may assist you in completing IRS Form 8863 – the form used for calculating the education tax credits that a taxpayer may claim as part of your tax return.

澳门网站游戏电子平台大专 is unable to provide you with individual tax advice, 但如果你有问题, 你应该向有经验的报税员或顾问咨询.

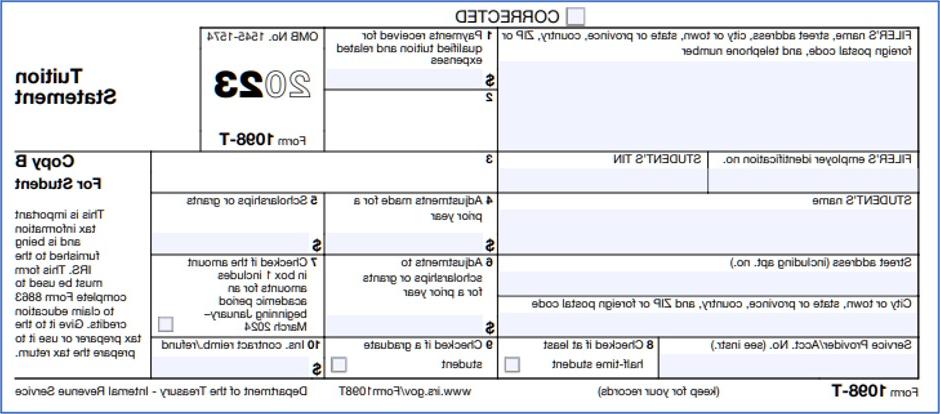

以下是2023表格1098-T的空白样本, 你将在2024年1月收到, 供你方参考. 有关1098-T表格的更多信息,请访问 http://www.irs.gov/forms-pubs/about-form-1098-t.

国税局不要求我们就下列事项生成1098t表格:

- 国际学生(除非要求提供SSN和/或TIN档案)

- 参加非学位课程的学生

- 未缴纳合格学费及相关费用的学生

- 箱1-已收到的合格学费和相关费用. 所报金额为…的总金额 支付 收到的款项减去历年期间的任何偿还或退款. The amount reported is not reduced by scholarships and grants reported in box 5.

-

- Payments received in the prior calendar year will not appear in 箱1 even if the semester started in the 2020 calendar year.

- 箱1 may be reduced by amounts billed in the previous calendar year for semesters starting in the 2020 calendar year.

- To review all 支付 and other credits applied to your account during the year, 请登录您的自助服务帐户. 在“学生财务”标题下选择“帐户活动”.

- 框2-从2019纳税年度开始,此栏将为空白.

- 盒3- This box will be checked since 澳门网站游戏电子平台大专 did change its method of reporting for the calendar year.

- 4盒- The amount of any adjustments made to qualified tuition and 相关费用 reported on a prior year Form 1098-T. This amount may reduce any allowable education credits students may claim for the prior year. 有关更多信息,请参阅IRS表格8863或IRS出版物970.

- 框5- The total amount of scholarships or grants paid and processed by 澳门网站游戏电子平台大专 during the calendar year. This may also include scholarships and grants posted in the reporting year for a prior year.

- 箱6-上一年度奖学金或助学金的调整金额. This amount may affect the amount of any allowable tuition and fees deduction or education credit students may claim for the prior year. 有关更多信息,请参阅IRS表格8863或IRS出版物970.

- 7箱- If checked indicates that the amount reported in 箱1 includes amounts paid for an academic period beginning in the next calendar year. (例如, 支付 made in December 2020 for terms beginning January – March 2021) See IRS第970号出版物 for more information.

- 盒8- Indicates whether students are considered to be carrying at least one-half the normal full-time workload for their course of study at 澳门网站游戏电子平台大专.

- 盒9-表示该学生是否被视为研究生.

- 10箱 -此框将为空白.

Qualified tuition and 相关费用 include undergraduate and graduate tuition, 学生活动费. The cost of course-related books and supplies, may qualify in certain circumstances.

不符合条件的费用包括食宿费, 保险, 医疗费用, 以及各种费用和收费.

有关更多信息,请参阅IRS表格8863或IRS出版物970.

Students can see the activity on their student account by logging into 自助服务, 去学生财务部, 然后点击Account Activity链接.

澳门体育赌博十大平台不能提供税务建议. Individuals should consult their tax professional to find out more about their eligibility for tax credits and/or the taxability of your scholarships. 也可从以下网址取得资料 美国国税局网站.

我们的联邦身份证号是74-6002420. 它包含在学院制作的所有税务文件(W-2, 1098-T等)中.).

我还是有问题可以联系谁?

澳门网站游戏电子平台大专 has provided the Form 1098-T in compliance with IRS guidelines. However, SWTJC is unable to answer any tax-related questions or provide any tax advice on this issue.

All information and assistance that SWTJC can provide is contained in this notice. 本通知的内容不作为法律或税务建议.

有关税务问题, please contact the Internal Revenue Service (IRS) at 1(800) 829-1040 or your personal tax advisor for further assistance.